Saud regime: Austerity at home while investing in American entertainment

The wrong policies of the Saudi regime and their commercial and military gambling in the world led to unprecedented negative consequences for the state and its citizens who bid farewell to the era of well-being, after having decades of prosperity.

For the first time, the Kingdom approved “painful” measures to save the budget from a large deficit. These measures included increasing the value-added tax from 5% to 15% starting from the first of next July, and stopping the exchange of the cost of living allowance as of next June.

With all these and other measures, the Kingdom said it was compelled to avoid the consequences of the Coronavirus and the general oil price war.

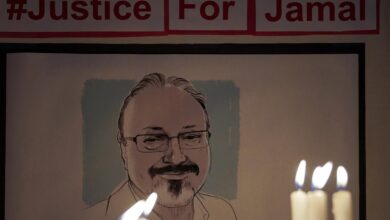

Outside the Kingdom, Saudi regime goes with the Kingdom’s money to invest in the entertainment sector in the United States of America, which may show a willingness to turn a blind eye to its record related to human rights violations and the murder of journalist Jamal Khashoggi.

During the month of April, Saudi House bought a share of $500 million, or five per cent, of the shares of the music broadcast company Live Nation, becoming the third largest investor in it, after the value of its shares decreased by more than 40 percent.

During the first quarter of this year, the kingdom invested $500 million in Walt Disney.

On May 6, the Hollywood Reporter magazine reported that new deals will be concluded by the Kingdom of Saudi Arabia during the coming period, noting that the Saudi Public Investment Fund offers to buy shares in Time Warner Music Group.

Buying shares in “Life Nation” was the first operation of a “public investment fund” in an American entertainment company, since the assassination of the Saudi journalist and writer for the “Washington Post” newspaper, Jamal Khashoggi, inside his country’s consulate in Istanbul, Turkey, in October 2018. At that time, Hollywood companies and institutions announced their boycott of the Kingdom of Saudi Arabia in protest.

But the “Hollywood Reporter” magazine pointed out that the Corona virus epidemic constituted a huge blow to companies in Hollywood who may prefer to sacrifice their public image in exchange for not losing their financial capabilities and the total collapse, which means opening the way more for the Kingdom of Saudi Arabia to invest in the sector, especially since its recent investments did not face Broad criticism, as before, via media platforms and social media.

In front of this Saudi attack on Hollywood, Karen Attia, the editor of the World Opinions section of the Washington Post, said that “companies accept blood-stained money from a system that does not care about imprisoning social media stars, torturing the most famous feminist activists, and killing a Washington Post writer. “Threatens freedom of expression there in exchange for the happiness of investors.”

Attia warned in an article entitled “the catastrophic capitalism of Saudi Arabia arrives in Hollywood”, published by the “Washington Post” on Monday, that “the continued American entertainment sector in dealing with the Kingdom of Saudi Arabia shows the world its willingness to throw American values and morals into the garbage.”

The US data showed that the Saudi sovereign fund had bought a share of $713.7 million in Boeing and an estimated stake of 522 million in Citigroup and another with the same value on Facebook, as well as a share of $495.8 million in Disney, and a value of 487.6 million in Bank of America.

Sharif Othman, a specialist in financial and economic affairs at the Washington Analytica Corporation, said that the Saudi move takes advantage of the investment opportunities created by the Coronavirus pandemic, which led to the depreciation of the shares of major American companies.

Othman said that the current conditions entice investors to buy, especially with the decrease in the value of the shares of these companies, expressing his surprise at the Saudi sovereign fund’s purchase of shares in these companies in light of the strict austerity policies that Riyadh follows due to the low value of oil revenues and the consequences of the spread of the Coronavirus pandemic.